No Medical

life insurance

- life insurance price points

Take advantage of price breaks based on life insurance amounts

It's important to understand that there are price points or certain

amounts of term life at which the average dollar per coverage

drops.

It's the closest equivalent to a "bulk discount" that life insurance

carriers offer.

Let's run some quotes and take a look at how this works.

Keep in mind you can always test different levels of insurance right through

the online quote here:

Also, our expert advisors will be able to guide you on where the sweet spot

is for life insurance amounts.

Just call 800-710-0455 or

email us for this free service.

Price point introduction for life insurance

First, each carrier has different pricing models but there are some key price

points that usually hold true.

As long as you can afford the monthly premium, a key concern when picking

the right

life insurance plan is the cost per dollar of coverage.

This is very different from the premium amount you pay.

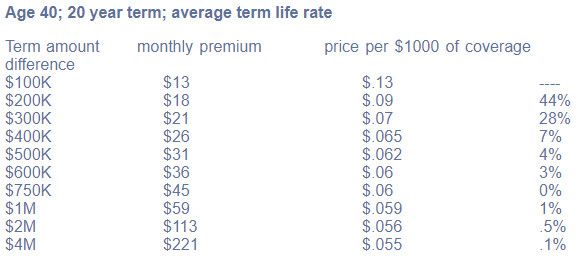

Let's take a quick look at an actual quote we ran to show the cost per

dollar.

So let's break down these figures.

First, let's look at the first two columns.

If this person buys $100,000 of term life insurance for a 20 years term, the

cost would be 13 cents for each $1000 dollars of coverage each month.

This is still very inexpensive for life insurance coverage.

Now, look at the second column.

If this person buys an extra $100K for a total of $200K (double the initial

amount), then the cost per $1000 of coverage is 9 cents.

That a huge 44% savings when comparing the key metric of cost per dollar of

life insurance coverage.

You would much rather pay 9 cents than 13 cents.

What this means is that if you can afford either monthly premium ($18 or

$13), then you are getting a much better value going with the $200K.

On the next step up, there is a 28% discount going from $200K to $300K in

coverage.

That a difference of 9 cents per $1000 of coverage versus 7 cents.

The monthly

term life premium difference would be $18 versus $21.

28% is still a pretty big discount.

As you keep working down, the discount percentage drops with each extra $100K

of coverage but there's still a discount.

If you can afford the 100K-500K level, there's a strong reason to look at the

$500K or $600K range assuming this meets your term life amount needs.

It's still amazing that a healthy 40 year old can look at around $40/monthly

for $750K of coverage.

Term life really has become pretty inexpensive over the years.

The discount starts to narrow as you get into higher amounts but keep in mind

that a) it still exists and b) it is applied to a much higher amount of term

life coverage.

For example, with $1M of coverage costing $59 monthly, a doubling of this

cost would be $118.

Instead, $2M of coverage is $113.

Ultimately, your

life insurance needs dictate how much to buy but it's smart to understand

how these price point discounts work among different levels of coverage.

Either run a

term or no-medical life quote, talk to an expert at 800-710-0455, or

email us!

Again, there is absolutely no cost to you for our services. Call

800-710-0455 Today!

and more!

and more!